Blog

Understanding the 28/36 Mortgage Rule

October 25, 2023

- The 28/36 Mortgage Rule

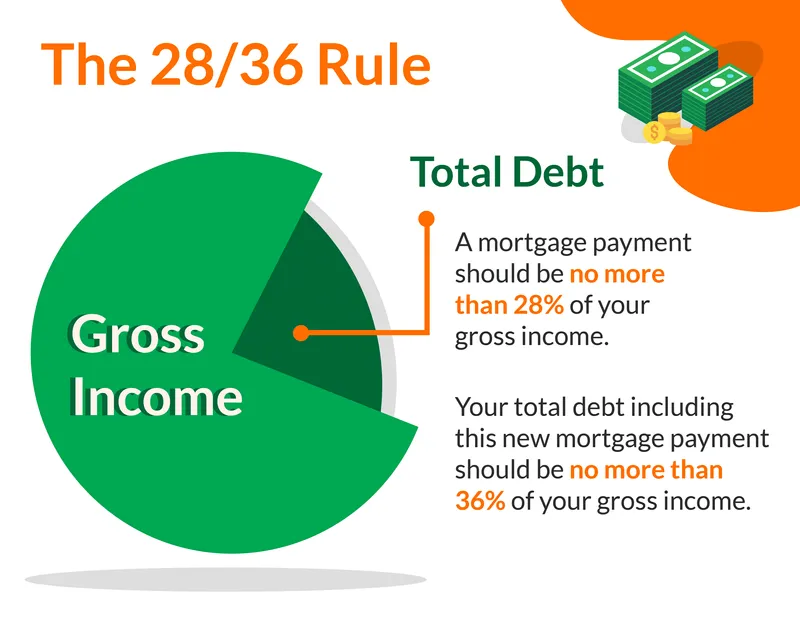

Before you start shopping for a home, take a look at how much income you have coming in each month and how much goes out each month to cover debt and other payments. One common rule of thumb for determining how much you should spend on housing costs is known as the 28/36 rule. Many lenders employ this guideline when looking at a borrower’s finances. According to this rule, you shouldn’t spend more than 28 percent of your gross income on housing, and no more than 36 percent on your total debt burden. That includes housing, car payments, student loans, credit cards or any other monthly payments you may have.

Here’s how the math breaks down for a $50,000 annual salary:

- $50,000 / 12 = $4,167 per month

- $4,167 X 0.28 = $1,166, your maximum monthly housing payment

- $4,167 X 0.36 = $1,500, your maximum monthly debt

- How much house can you afford?

According to Bankrate’s mortgage calculator, a $200,000 home with a 20 percent down payment and a 30-year-fixed mortgage at 6.5 percent interest leaves you responsible for $1,011 in monthly principal and interest costs. You’ll have $155 per month left to cover variable fees like property taxes, homeowners insurance premiums and any applicable HOA fees before you exceed the 28 percent recommendation.

- Your credit score: Higher credit scores make you eligible for lower interest rates, so if yours is less-than-stellar, consider taking some time to pay down your balances and build up your credit before you start house-hunting.

- Your DTI: DTI, or debt-to-income ratio, is a measure of how much you make versus how much you spend. It’s like the 36 part of the 28/36 rule. Some lenders will allow a higher number than 36, but it will likely come with a higher rate to match.

- Your down payment: The more money you are able to put down upfront, the less money you’ll have to borrow to make your home purchase —and the lower your monthly payments will be. While 20 percent of the home’s price is traditional, that sum can be daunting for many people, and there are several mortgage options with lower down payment requirements (if you qualify).

Common types of loans

- Conventional: A conventional loan, the most common type of mortgage, usually requires a minimum credit score of 620 and a minimum down payment of 3 percent (although you’ll have to pay for private mortgage insurance, or PMI, with a down payment of less than 20 percent).

- FHA: These popular loans are more flexible about credit score and DTI. But you’ll still need to pay PMI with a down payment below 20 percent.

- VA: If you are active-duty military, a veteran or a surviving spouse of either, you may be eligible for a zero-down VA loan.

- USDA: USDA loans cater to low- and moderate-income buyers in approved rural areas. If you’re looking in an approved area you may be in luck, but if you want a city home, they’re not right for you.

Next Article